courtneyk

Thesis

CCC Clever Answers Holdings Inc. (NASDAQ:CCCS) is a leader in automotive estimating application, which is mission-significant for insurance coverage carriers and car repair service amenities. The small business is effectively-positioned to accomplish the best-line growth profile of 7-10{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} in the very long-time period, with 40{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} medium-expression margins. I believe the firm’s existing valuation is in line with peers and see really confined margin enlargement probable from current degrees. I keep a December 2023 rate concentrate on of $11 on the inventory with an assumed ahead CY24 EV/EBITDA numerous of ~20x, in-line with the firm’s historical ahead EV/EBITDA multiple.

CCCS stock price movement about the past 12 months (Seeking Alpha)

Why I Preserve a Keep score on CCCS?

CCCS is a main supplier of estimating software for automobile insurers and maintenance services

CCC’s core giving is estimating software for automotive actual physical damage, which can help give insurers and mend services the equipment to estimate the fees of restore precisely. The motive this is crucial is estimates travel claims, which is the primary cost for insurers, but also the principal knowledge for the insured buyer. For insurers, CCC presents distinct regional sections/labor fees precise to the motor vehicle make/design, permitting them to give an correct estimate at a time when the prices of mend are escalating faster than historic degrees as vehicles develop into additional sophisticated with technologies. Moreover, a a lot more precise estimate is not inflated, cutting down leakage, which CCC estimates to be a $50 billion annual cost to the world wide insurance policy sector. For the insured purchaser, the practical experience with a CCC-centered ecosystem is far more seamless- much more carriers function direct repair programs with restore stores that make it possible for consumers to receive a lot quicker, exact estimates and expedite the time to getting their vehicle back again or getting compensation in a full decline situation. I believe CCC is incorporating benefit to both of those the provider and the mend facility, which is why it counts 18 of the top 20 US insurance plan carriers and ~27k of the ~40k repair shops in the US as buyers, producing it the main seller in the United States.

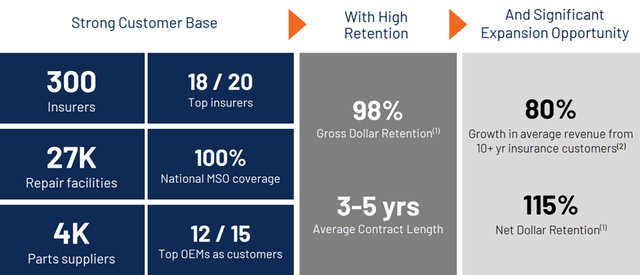

Sticky customers with prolonged-expression contracts and high gross retention prices

CCC’s mission crucial applications, its blue-chip insurance plan carrier foundation, and recognized foundation of repair facilities drive prolonged-expression engagements with large gross retention charges. Precisely, I think CCC’s coverage carrier buyers have normal agreement durations of 3-5 years, while the repair services have common agreement durations of 3 several years – in a lot of instances customers in each segments have renewed various occasions above CCC’s 40-year everyday living. Most importantly, I see this from the greenback standpoint as well, with the gross retention level of ~98{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} demonstrating that CCC’s main instruments and the toughness of its finish vertical help very long-phrase engagements. In addition, I imagine CCC has been equipped to command better run-fees from present consumers, as revealed by net retention prices (NRR) that have been in the 103-107{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} variety above the previous 3+ yrs. I imagine CCC can at the very least maintain this NRR mainly because of (1) progress from its main estimating resources by means of possibly pricing or more volume (2) new items that seize far more wallet share from the provider or mend shop. On the 2nd place, I believe two items could be specially exciting, Estimate Straight-By way of-Processing and Diagnostics. Estimate STP would make it possible for carriers to use AI instruments to take a look at visuals of automobile actual physical problems, and appear up with an correct estimate without applying a human adjustor in the process. Diagnostics would be a tool utilised by repair service outlets to additional correctly diagnose challenges with vehicles to also improve their estimates. With these new products and the energy of its main estimating tools, I believe CCC can see ~110{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} NRR very long-expression, which would assist most of its 7-10{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} very long-time period earnings expansion goal.

CCCS has a substantial customer retention (Organization Presentation)

Years of proprietary automotive mend facts and a hard aggressive landscape make it difficult for new entrants in this sector

There are at the very least two structural dynamics that generate obstacles to entry – (1) CCCS’ proprietary automobile/fix/value knowledge and (2) a tough aggressive landscape. Initially and most likely most importantly, CCC has been a technologies chief in the P&C insurance plan financial state for a number of many years and has processed in excess of $1 trillion really worth of transactions through its background. By means of its transaction history, CCC has constructed up a massive databases that spans insurance claims, auto repairs, automotive components, and other car or truck-specific data. In my check out, CCC utilizes this historical data to give carrier and maintenance shop shoppers additional exact estimates no issue what the automobile or restore method, which is challenging to replicate by newer entrants or the inside databases of its clients.

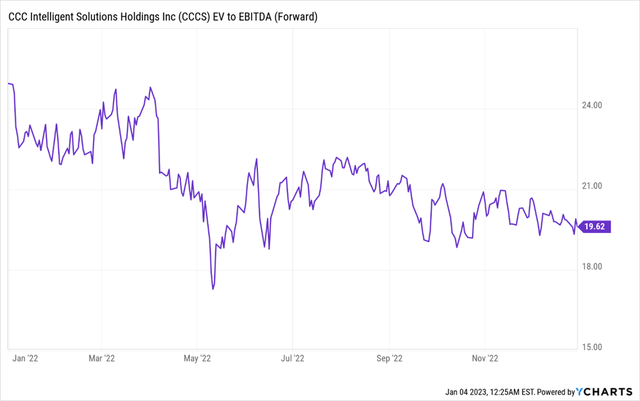

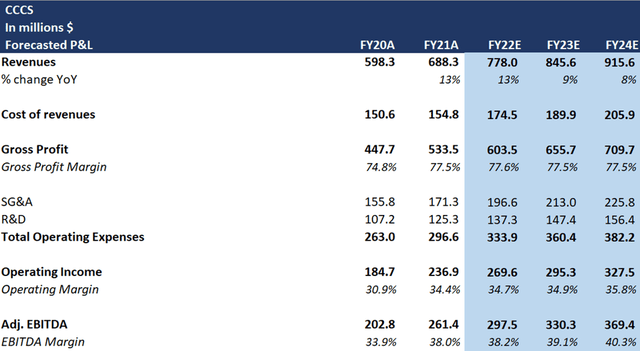

CCCS Valuation is in-line, I see the current several challenging to develop in the very long time period

CCCS is a experienced software organization concentrating on 7-10{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} lengthy-phrase income progress and ~40{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} EBITDA margins, so I believe that valuation should triangulate across multiple metrics, exactly where I see CCCS buying and selling possibly in-line or at a slight top quality to friends. Mainly because the enterprise manages to/guides to EBITDA, I think far more traders gravitate in the direction of EV/EBITDA valuation – which is in-line with Verisk Analytics, Inc. (VRSK) and Cadence Structure Devices, Inc. (CDNS), two comparables of the company. My December 2023 selling price focus on of $11 is premised upon ~20x CY24E EV/EBITDA, in-line with the firm’s historical ahead EV/EBITDA a number of.

CCCS Ahead EV/EBITDA (YCharts) CCCS forecasted P&L (my estimates)

Final Feelings

CCCS is a chief in vehicle estimating computer software for coverage carriers and maintenance stores, with 98{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} gross retention and limitations to entry. The firm’s estimating software package has a primary share with 18 of the top rated 20 automobile insurance carriers and 27k vehicle restore amenities. CCC has a mature economical profile, and I see minimal a number of growth opportunity from current amounts. I watch EV/EBITDA as the major valuation metric to worth CCCS, and my December 2023 $11 cost goal various performs out to ~20x CY24E EBITDA, in-line with the firm’s historical forward EV/EBITDA multiple.