deepblue4you/E+ via Getty Images

Advance Auto Parts, Inc. (NYSE:AAP) is a leading automotive aftermarket parts provider in North America. The types of products sold by the company include parts & batteries, accessories and chemicals, and engine-related maintenance products, such as air filters and transmission fluid. Their customers include both professionals and DIYers. As of December 31, 2021, sales to professionals accounted for nearly 60{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} of total net sales.

As an aftermarket parts supplier, AAP benefits from providing automotive solutions to older vehicles that need more continuous repairs & maintenance. In the current market environment, AAP is poised to benefit from widespread affordability constraints of purchasing a vehicle.

In May 2022, the average new-vehicle transaction price is expected to reach nearly +$45K, which would be up 16{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} from 2021. Prices for used cars offer no better alternative, with prices up nearly 30{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} from January 2021. As such, there is a greater likelihood of individuals holding onto their cars for as long as they can. In fact, the average age of vehicles on U.S. roadways reached a record high of 12.2 years in 2021. For AAP, this means increased demand for brakes and brake pads, batteries, tires, and other accessories.

AAP also benefits as total vehicle miles traveled increases. In 2019, total miles driven reached 3.26T, before plummeting to 2.83T during the height of the COVID-19 pandemic. The data has since improved and is now at or near 2019 levels. With increased travel comes greater maintenance requirements.

U.S. Federal Highway Administration, Moving 12-Month Total Vehicle Miles Traveled [M12MTVUSM227NFWA], retrieved from FRED, Federal Reserve Bank of St. Louis![U.S. Federal Highway Administration, Moving 12-Month Total Vehicle Miles Traveled [M12MTVUSM227NFWA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M12MTVUSM227NFWA, May 28, 2022.](https://static.seekingalpha.com/uploads/2022/5/28/49921492-16537701399295.png)

With the wind at their back from an aging vehicle fleet and total miles driven, one would not expect AAP to be underperforming the broader market. Yet, AAP is down nearly 20{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} YTD, which is worse than the S&P’s 13{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} decline over the same period. For investors seeking an under-the-radar play in the automotive sector, AAP is one name worth extra attention.

Earnings Review and Other Reportable Events

In the first quarter ended April 23, 2022, AAP reported total net sales of +$3.4B, which was up 1.3{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} from the same period last year, but +$20M short of estimates.

Through the first ten weeks of the year, AAP had a strong start, with YTD comparable store sales up mid-single digits. The final six weeks, however, came under pressure from flagging DIY sales, resulting in mid-single digit declines in comparable sales.

Weighing on the DIY comparisons were the impacts of economic stimulus payments in the prior year and a slower start in the current period, especially in the northern regions, due to colder and wetter weather patterns.

Despite weakness in DIY, overall comparable store sales were up 0.6{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} from the prior year and 25.3{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} on a two-year basis. The increase represented the 8th consecutive quarter of comparable store sales growth. Likewise, both adjusted operating income and adjusted EPS grew for the 8th straight quarter.

Gross profit margins came in at 44.6{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157}, which was flat compared to the prior year. Considering the significant input cost inflation over the past year, this is positive news. Driving margins in the current period were improvements in strategic pricing, offset by LIFO expense.

Q1FY22 Earnings Summary – Form 10-Q

SG&A expense as a percentage of net sales, on the other hand, was up 161 basis points, due to increased inflationary pressures in store labor, in addition to higher fuel and delivery expenses. Additionally, AAP incurred higher start-up costs from new store openings related to their expansion in California. The higher level of SG&A ultimately weighted on operating income and net income, with both down about +$50M for the quarter.

Looking ahead, AAP expects improvements in DIY due to the waning impacts of last year’s stimulus package on comparisons. Additionally, management affirmed full-year guidance, which calls for +$11.2B in total net sales on the low end and an adjusted diluted EPS range of $13.30 to $13.85, which would peg shares at 14.51x to 13.94x forward earnings, based on the closing price on Friday, May 27, 2022.

Q1FY22 Earnings Release – FY22 Full-Year Guidance

The Fundamentals

Author’s Summary of Strength of Fundamentals

At quarter end, AAP had +$139M in cash on hand and +$1.2B available on their unsecured revolving credit facility. With +$6.1B in total current assets and +$5.1B in total current liabilities, the company is adequately capitalized to meet its short-term obligations. Since inventories account for nearly 80{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} of total current assets, turnover is critical in maintaining their liquidity position.

Author’s Calculations of Various Short-Term Liquidity Ratios

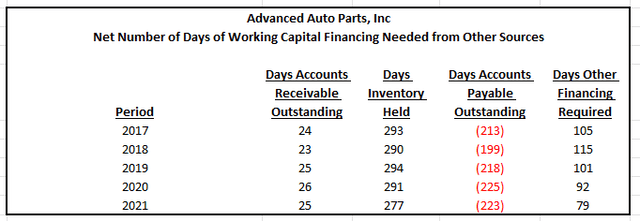

Through the first three months of 2022, AAP was able to turn over their inventory in about 277 days. This is in-line with their performance in 2021 and better than in prior years. Stacked against the timing of collections and payments, there were 75 days in which the company required funding from sources other than through their suppliers. This is progressively better than the 101 days reported for 2019.

Author’s Calculations of Days of Other Required Financing

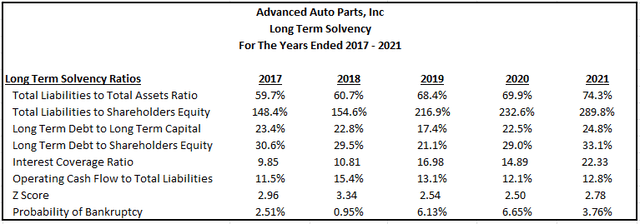

From a longer-term standpoint, AAP’s leverage stood at 3.5x TTM EBITDA. And the fair value of total debt at period end was +$1.1B. Other than about $200M due in 2023, nearly all debt is due in the years after 2026. In the interim, the company’s strong interest coverage ratio of 22x indicates the company is unlikely to experience trouble servicing their reoccurring interest obligations.

Author’s Calculations of Various Long-Term Solvency Metrics

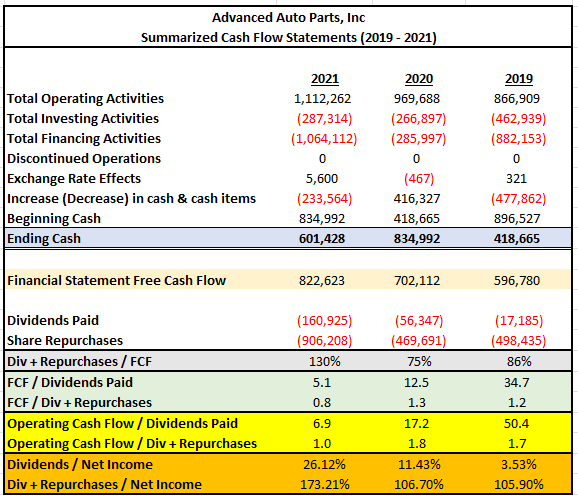

Supporting AAP’s liquidity position and their long-term viability is their strong ability to generate cash from operations. In the current period, the company reported a net use of operating cash of +$55M, due to lower net income and negative working capital adjustments. But cash flows are expected to catch up as the year progresses, with a minimum of +$775M expected in free cash flows (FCFs).

In 2021, AAP generated +$823M in FCF, which provided over 5x dividend coverage. Presently, the annual payout is $6.00/share for a yield of just over 3{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157}. From a coverage standpoint, management targets a payout ratio of between 35-45{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} of net income. In 2021, the ratio was just 26{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157}. So, the company does have ample breathing room with their targets.

Author’s Summary of Cash Flow Statement

Risks To Consider

Overall demand for AAP’s products is based on several factors that if impaired can negatively impact the company’s results of operations. For example, a decrease in the total number of vehicles on the road or in the number of annual miles driven can result in decreases in the need for maintenance and repairs. While miles driven have been trending higher, soaring energy prices are weighing on households across the country. If predictions by analysts at JPMorgan Chase & Co. (JPM) are accurate and gas prices reach $6, there is a real risk of demand destruction. This could be in the form of switching to public transportation, ride-sharing, or other means, all of which would result in structural headwinds for AAP.

In the most recent filing period, results were partially impacted by a slow start to the spring selling season due to colder and wetter weather than the previous year. Greater overall variability in the weather may result in further volatility in AAP’s business. On one hand, milder weather results in lower failure rates of automobile parts. On the other, consumers may defer elective maintenance in extended periods of rain and winter precipitation. While there is an element of predictability to weather patterns, unexpected changes could impact operations on a material basis.

Continued advances in technology, including higher adoption rates of electric or hybrid vehicles, in addition to a general increase in the quality of vehicles manufactured, pose long-term threats to AAP. Electric and hybrid vehicles, for instance, require less frequent oil changes and less frequent repairs using aftermarket parts. At present, many auto executives expect more than half of U.S. car sales to be EVs by 2030. If this comes to fruition, AAP’s existing business model could be challenged.

Conclusion

An aged vehicle fleet and steadily increasing miles driven are two current tailwinds for AAP. The company’s new DieHard EV battery is also expected to catch on to those with electric or hybrid vehicles who demand superior reliability and durability of the life of their batteries.

Despite a favorable outlook, AAP is underperforming the broader market index and is trading just 11.5{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} above their 52-week low. Additionally, the company’s current forward EV multiple is about 10.6x, which is discounted to similar peers, such as Genuine Parts Company (GPC), AutoZone, Inc. (AZO), and O’Reilly Automotive, Inc. (ORLY), who are trading at an average multiple of 13.2x. At this valuation, shares in AAP would be worth approximately $220, which would be nearly 15{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} higher than current levels.

Rising SG&A costs are headwinds that have already affected current period earnings, but the company is still on track with their full-year guidance. A stable balance sheet that includes +$1.3B in total liquidity with limited near-term debt maturities provides safety against uncertainty. Predictable cash flows inherent in the repair and replace market provide further assurance to investors seeking portfolio protection.

At just 14x forward earnings, AAP is one name in the automotive sector that provides value with reasonable upside potential, in addition to a fully-covered dividend yielding over 3{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157}. For investors seeking to add to their diversified portfolios, perhaps a pit stop at AAP is just what a mechanic would recommend.