RiverNorthPhotography

Earnings time is frequently a great time for cut price hunters to go shopping, and this newest spherical of earnings has proved no distinctive, developing cut price acquiring options in stocks these kinds of as Stanley Black & Decker (SWK) and V.F. Corp. (VFC). That is due to the fact disappointing effects can lead to analyst downgrades and current market over-reactions, creating prolonged-expression shopping for opportunities for price investors.

This provides me to Advance Automobile Elements (NYSE:AAP), which seems to be 1 this kind of possibility, whose cost is now buying and selling very well beneath its 52-week substantial of $244. In this report, I highlight why prolonged-phrase worth and dividend advancement traders ought to take a seem at this discount title, so let us get begun.

Why AAP?

Advance Car Components is a top parts supplier for the automotive aftermarket, serving both of those skilled installers and Diy consumers alike. It operates around 4,700 stores and 312 Worldpac branches mostly in the U.S., Canada, and Puerto Rico. AAP also serves 1,329 independently owned Carquest branded merchants, furthering its get to to more customers and markets. Over the trailing 12 months, AAP generated $11 billion in complete income.

AAP positive aspects from its scale, reach, consumer foundation, and brand name. The company’s scale is apparent in its substantial store footprint. This presents it a unique benefit over scaled-down rivals and even the on the net juggernaut, Amazon (AMZN) simply because buyers are much more probably to take a look at an AAP retailer when they have to have a part, due to its in-retail outlet knowledge, better stock turnover and availability of elements. These strengths are reflected by Morningstar in its recent analyst report:

In spite of Amazon’s current initiatives to indication distribution agreements with producers, we foresee that incumbent merchants will be ready to defend their privileged sector standing since of their in-retail outlet providers and ability to supply many classes of wanted factors on desire.

Really hard pieces are increasingly sophisticated and can range drastically based on the model 12 months and picked choices on any car. The purchase and installation of these products and solutions can be complicated, and the guidance presented by qualified in-keep sales personnel is difficult to replicate by means of do-it-oneself movies and on line assistants. Advance’s device personal loan offerings include additional benefit, as section installations from time to time involve a specialised instrument that is better borrowed from Advance than ordered for a one-use application.

Aside from the absence of customized provider, shoppers on the lookout to switch a unsuccessful vital part often need the portion right away in order to regain trustworthy use of a auto or truck in commuting or business enterprise. Handful of electronic merchants are equipped to blend depth of inventory with speed of supply.

In the meantime, AAP’s share value has taken a beating in the latest days, falling from the $210 degree from the center of this thirty day period to $181. This was pushed by almost flat gross sales progress of just .6{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} YoY and a .6{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} reduce in equivalent retailer product sales in contrast to the prior-12 months period of time. This compares unfavorably to peer O’Reilly (ORLY) which observed a 4{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} income advancement above the same interval. On the other hand, this could be owing much more to ORLY’s heavier reliance on inflation-sensitive lessen revenue consumers. As a reference, the Do it yourself segment represents 60{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} of ORLY’s client base when compared to 40{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} for AAP.

When AAP may perhaps go on to see issues in the around-expression, specifically as cost inflation pressures Diy prospects, I see the prolonged-phrase advancement thesis as becoming intact. Which is simply because AAP continues to develop into new destinations with supplemental stores, signaling a bullish lengthy-phrase outlook by the organization. It’s also investing in extra successful scale, which could introduce increased profitability more than the extended-operate. These aspects were famous by management throughout the new convention phone:

Rounding out our top rated line advancement initiatives, we’re executing our new store opening strategy. In the quarter, we opened 43 new spots, which include the latest opening of our flagship retail outlet in downtown Los Angeles. Our California growth is by now contributing to share gains in the West. Year-to-date, we’ve opened 78 new locations and stay on monitor to provide our yearly steering of 125 to 150 new retailers and branches.

We are streamlining and simplifying our supply chain to increase assistance and minimize expense. We continue on to rollout a single warehouse management system across the Advance and Carquest DC community and are on monitor to comprehensive the implementation by the stop of 2023. We have also started activating features of our labor management suite of applications throughout our DC community and are commencing to see efficiency rewards.

In the meantime, AAP maintains an financial investment grade rated BBB- harmony sheet and it’s considerably developed its dividend about the past pair of decades. It currently yields a nutritious 3.3{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} at the existing cost, and the dividend is effectively-shielded by a 40{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} payout ratio.

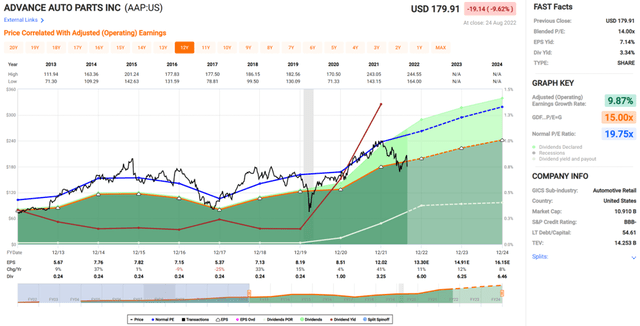

I see value in AAP immediately after the the latest fall in price tag. At the current selling price of $181, AAP trades at a forward PE of just 13.6, sitting down nicely under its standard PE of 19.8 in excess of the previous 10 years. Analysts count on 8{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} to 13{09e594db938380acbda72fd0ffbcd1ef1c99380160786adb3aba3c50c4545157} annual EPS development in excess of the next 3 decades, and have a consensus Buy score with an common price tag goal of $214, even though Morningstar has a $234 honest benefit estimate. This translates to most likely powerful double-digit complete returns.

AAP Valuation (Quick Graphs)

Investor Takeaway

Advance Car Areas is a wonderful price play in the auto elements retail market. The enterprise has a strong very long-term advancement thesis, driven by enlargement into new marketplaces and investments in supply chain effectiveness. On the other hand, it faces around-phrase headwinds from price tag inflation pressures, which could impact Do it yourself shoppers. However, at the recent price of $181, I see significant upside possible in AAP for affected person traders.